Montana Royalties – USA

In January, 2019 Solitario announced it had sold two royalties and an option to purchase a third royalty to SilverStream SEZC (“SilverStream”), a private Cayman Island royalty and streaming company. Solitario will receive CDN $250,000 in cash and CDN $350,000 in a convertible note as payment for the royalties and option. The royalties cover the 125,000-acre polymetallic Pedra Branca palladium, platinum, gold, nickel, cobalt and chrome project in Brazil and Solitario’s 3,880-acre Mexico royalty portfolio. The purchase option covers Solitario’s 16,500-acre Montana royalty portfolio.

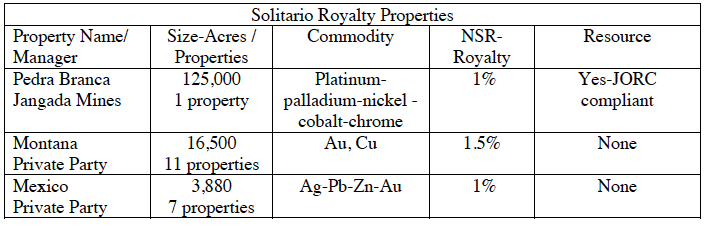

The centerpiece royalty is the 1% NSR royalty on the Pedra Branca project owned by Jangada Mines, a London-based company that is actively advancing the project. The property has a JORC compliant resource. The Montana royalties cover high-potential geologic terrain for copper-gold mineralization and the Mexico royalties include prospective areas for precious and base metal mineralization in historic mining districts of Mexico. The CDN $350,000 convertible note has a one-year term with a 5% per annum simple interest rate. The note is convertible into SilverStream stock should SilverStream complete an IPO before the end of the one-year term. For more information see the 01/22/2019 Press Release.

Solitario recently announced that it had purchased a 1.5% Net Smelter Return (“NSR”) royalty on 15,831 acres of highly prospective mineral properties in Montana. The royalties were purchased from Atna Resources Inc. (“Atna”) as part of its Chapter 11 bankruptcy auction process.

In 2012, Atna evaluated the mineral potential on approximately 830,000 acres of mineral rights that it held in western Montana to create a portfolio of NSR royalty properties. Atna’s criteria for creating royalty properties from this vast mineral holding were the presence of surface mineralization, historical mining and favorable geology defined by exploration programs conducted by Anaconda Copper, Phelps Dodge and several other companies. Atna identified 11 properties with the highest mineral potential and created a 1.5% NSR royalty on these parcels. With this purchase, Solitario now owns the royalty on these 11 properties.

The royalties pertain to privately deeded property and are thus perpetually titled. Solitario’s $2.50 per acre bid won the royalty rights on these 15,831 acres. The purchase price is the only investment Solitario will ever have to make to retain these royalties in perpetuity. Voluminous technical information suggests excellent potential for Cu, Cu-Au, Cu-Ag and polymetallic mineralization on these properties that is consistent with the largest mineral deposits located in western Montana.