Florida Canyon Zinc Project – Peru

Introduction – History and Joint Venture Terms

High grade massive zinc and lead sulfide surface exposures were discovered by Solitario in 1994 as a portion of a larger regional exploration program called Bongará (later to be renamed Florida Canyon) in the Amazonas region of Peru. In 1996 Solitario formed a joint venture with Cominco Ltd. which drilled a total of 82 core holes and conducted extensive surface exploration over the property.

In 2006 Solitario and Votorantim Metais (later to be renamed Nexa Resources) entered into a new joint venture covering the property. Nexa has increased the total number of drill holes on the property to 486 comprising over 117,000 meters of core. Nexa has also completed programs of tunneling, underground drilling, metallurgy, and various other engineering studies.

The terms of the Solitario-Nexa joint venture and current status are summarized:

- Nexa is the Operator of the joint venture and currently holds 61% of the joint venture company, Minera Bongará.

- Nexa will fund 100% of all costs through the completion of a feasibility study (with no payback) upon which Nexa will earn a 70% interest in the JV.

- Nexa will fund all of Solitario’s 30% portion of construction costs under a loan facility (at Solitario’s election) which will be repaid through 50% of the cash flow of the mining operation.

Resources

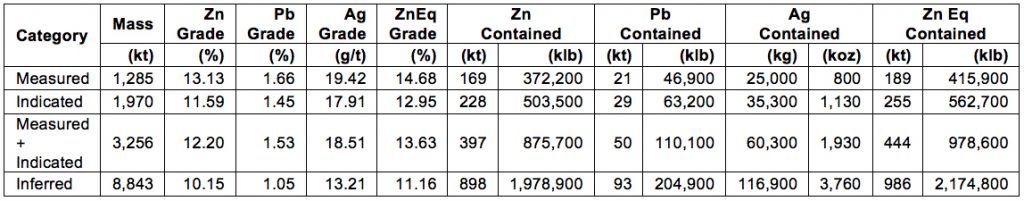

In 2014 Solitario commissioned SRK Consulting (SRK) to estimate the mineral resource for Florida Canyon summarized in the following table.

Mineral Resource Statement for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., 05 June, 2014

Source: SRK, 2014

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves;

- Mineral resources are reported to an NSR zinc-equivalent (ZnEq%) cut-off grade based on metal price assumptions*, metallurgical recovery assumptions**, mining costs, processing costs, general and administrative (G&A) costs, and NSR factors***. Mining costs, processing, G&A, and transportation costs total US$51.30/t.

- *Metal price assumptions considered for the calculation of metal equivalent grades are: Zinc (US$/lb 0.95), Lead (US$/lb 0.95) and Silver (US$/oz 20.00),

- **Cut-off grade calculations assume variable metallurgical recoveries as a function of grade and relative metal distribution. Average metallurgical recoveries for sulfide and oxide respectively are: Zinc (93.1%, 73%), Lead (84.8, 0%) and Silver (55.6%, 0%)

- *** NSR factors for calculating cut-off grades were: ZnEq% = Zn% * 1 + Pb% * 0.74 + Ag g/t * 0.02

- Resulting cut-off grades used in this resource statement were 4.1% ZnEq for sulfide, 5.0% ZnEq for oxide, and 4.5% ZnEq for mixed material types.

- Zinc equivalency for reporting in situ resources was calculated using:

- ZnEq (%) = Zn (%) + 1.0 * PB (%) + 0.03 * Ag (g/t)

- Density was calculated based on material types and metal grades. The average density in the mineralized zone was 2.91 g/cm3 as a function of the zinc and lead sulfide mineral content.

- Mineral Resources as reported are undiluted.

- Mineral resource tonnage and contained metal have been rounded to reflect the precision of the estimate, and numbers may not add due to rounding.

- There are no Mineral Reserves previously developed for the deposit.

2017 Preliminary Economic Assessment (100% basis of Project)

In November 2016, Solitario announced it would initiate a PEA on the Florida Canyon deposit. In January 2017 SRK was engaged to complete the PEA. In April 2017, Nexa elected to participate in funding and preparation of the PEA.

Mine Plan

The PEA designed the mine as an underground operation utilizing conventional mining methods with an average throughput rate of 2,500 tonnes per day, or approximately 912,000 tonnes per year. Depending upon the geometry of the ore zones, longhole stoping will be used in steeply dipping zones and mechanized drift-and-fill extraction methods in shallowly dipping mantos. Minimum mining heights of drift-and-fill stopes are 3m or 4m depending on the geometry of the ore. Longhole stopes will be developed on 16m sublevels. Stopes of 8m or less in width will be developed longitudinally whereas stopes with thickness of greater than 8m will be developed by transverse stoping.

Cemented paste backfill will be placed underground to increase mining recovery and to stabilize mined-out areas. Adits provide access from the surface to the ore zones. The mill head grades from the mine do not vary significantly during the first ten years, but the grade in the final three years of the current mine plan is moderately lower.

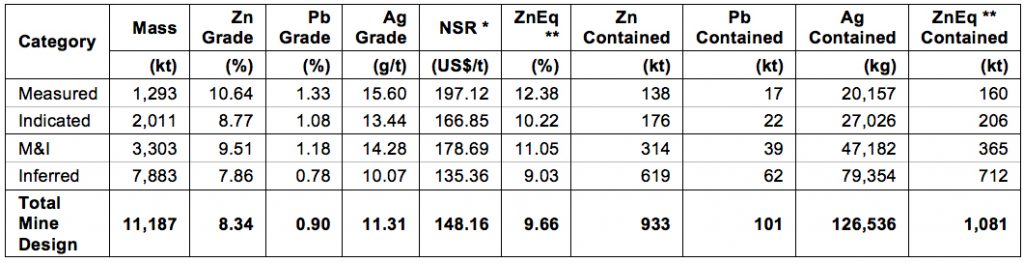

Mine Plan Resource

The Florida Canyon deposit consists of high grade zinc and lead sulfide bodies with silver credits contained in both flat lying “mantos” and more steeply dipping breccia bodies. The resource has been estimated using 486 surface and underground core holes. Twenty individual domains have been constrained in the resource model by wireframed 3D solids.

The Mine Plan Resource takes into account metallurgical recoveries based on composition. It is neither a Mineral Resource or a Mineral Reserve as defined by CIM guidelines. It is presented to define the material used in the preparation of the mine plan for this PEA.

Although the modeled mineralization is primarily sulfide, oxidation of the ore is also present. Metallurgical testing shows that mixed ore can be economically processed with good recovery of metal. Blocks in each domain in the Mine Plan Resource model have been assigned a grade, density and metallurgical recovery in order to define their net smelter return value. Internal mining dilution of 34% has been applied. These block-by-block NSR values were used to design the mine plan. The average NSR value of the mineable resource is $148.16 per tonne.

The mine plan resource is tabulated below.

Mine Plan Resource for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 21, 2017

Source: SRK, 2017

- * NSR is calculated using variable recoveries based on sulfide/oxide ratios (recovery ranging from 32%-93%), a Zn price of US$1.20/lb, a Pb price of US$1.00/lb, an Ag price of US$17.50/oz. The transportation charge is US$70.00/t conc, Zn treatment charge of US$115/t conc, Pb treatment charge of US$100/t conc, Zn refining charge of US$0.115/lb Zn, and Pb refining charge of US$0.1/lb Pb. These factors were used for mine planning and vary somewhat from the final economic model.

- ** ZnEq estimate is based on a NSR value of US$19.62 per 1% Zn. The US$19.62 is calculated using a Zn price of US$1.20/lb, a Pb price of US$1.00/lb, an Ag price of US$17.50/oz. The ZnEq also includes TC/RC and transportation costs and assumes an average Zn recovery of 78.15% which differs somewhat from that presented in the economic model. An example of the NSR to ZnEq calculation is (148.16/19.62)/0.7815

Processing and Metallurgy

The PEA incorporates a conventional mill design flow sheet with three-stage crushing followed by single-stage grinding to 80% minus 44 microns, with two multi-stage flotation circuits. The first circuit will produce a lead concentrate and the second multi-stage flotation circuit, the zinc circuit, receives tails from the lead circuit to produce a zinc concentrate.

Tailings from the flotation plant will be thickened to approximately 50% solids by weight. A fraction of the tails representing approximately 60% of the solids will be piped to a filtration plant located by the tailings storage area and then dry stacked at a moisture of approximately 17% by weight. The remaining 40% of the solid’s stream will be transfer to a backfill plant to be used in the underground operation.

Metallurgical testing has indicated that the ore does not contain penalty elements that would attract extra smelter charges.

Location, Infrastructure and Power

The project is located approximately 8 km from a paved road that connects coastal northern Peru with the Amazon basin. Infrastructure required for mining includes expansion of a local access road network, a mill, new mine development and a dry stack tailings facility. Power will be provided by a hydroelectric facility owned by a third party.

Environmental and Social Considerations

The small footprint of the underground mine design reduces surface disturbance and the use of tailings backfill minimizes the storage requirement for tailings on the surface. Waste rock will be used in tailings facility construction and for underground structural fill, thereby minimizing the need for waste storage on the surface. Low iron sulfide content in waste and ore combined with carbonate host rocks creates a net neutral geochemical environment which minimizes impacts to local water resources. The use of locally produced hydroelectric power will reduce air emissions compared to on-site power generation.

Opportunities

Delineating additional resources is the most promising opportunity to significantly enhance project economics. The most prospective targets include:

- Extension drilling south of the San Jorge zone and northeast of the Karen-Milagros zones are considered the highest priority to increase high-grade zinc sulfide resources. Both zones are open in the recommended areas of drill testing.

- Infill drilling several large un-tested areas surrounded by mineralized zones within the mineralized footprint has the potential to significantly increase resources.

- Extension drilling peripheral to the currently defined mineralized footprint which is open in several locations.

- Additional resource development in the immediate vicinity of the Florida Canyon resource footprint will likely be sulfide mineralization which will improve project metallurgical recoveries.

Opportunities 1 – 4 are planned to be tested in 2018 and 2019

- More detailed mine scheduling could optimize revenues in the early part of the mine life and further enhance project economics.

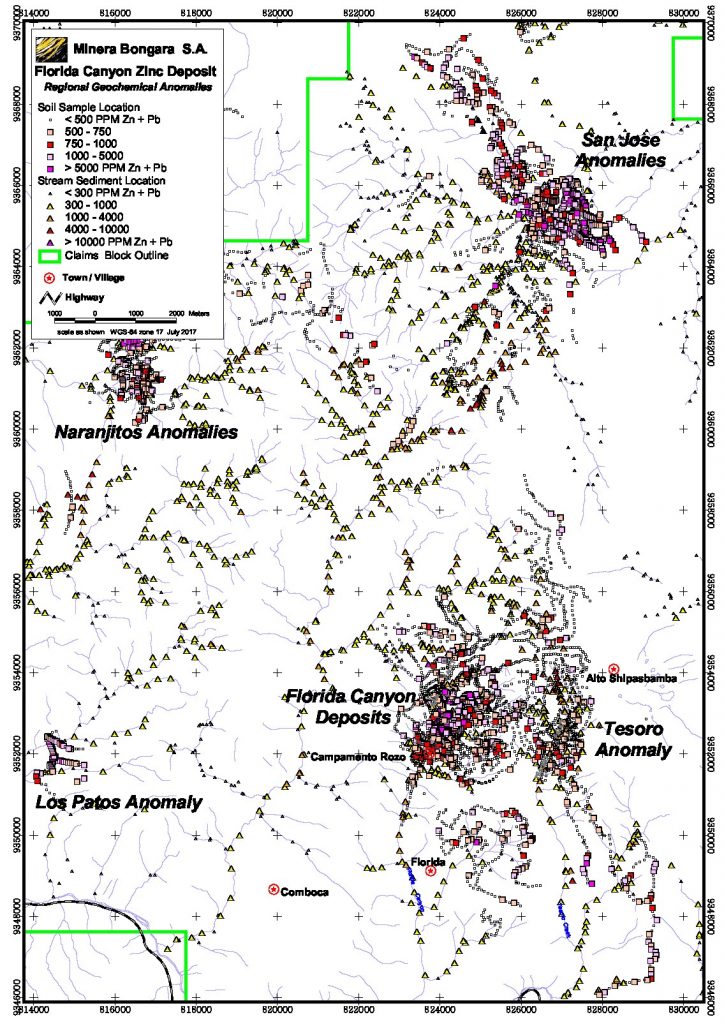

- Further development of drill targets over the 20 kilometer-long northern Florida Canyon mineralized corridor where large areas of strong zinc in soil and rock chip geochemistry indicate the potential for additional mineralized zones. (See figure below).

Although metallurgical studies to date indicate excellent zinc recoveries in sulfides (+90%), it is likely that average recoveries and higher concentrate grades can be achieved for the global resource base that includes some oxidized material. More detailed metallurgical optimization tests are required to determine this.

Additional trade-off studies may develop more efficient tailings management to reduce construction and closure costs.

Recent Developments

In January, 2019 Soliltario’s partner, Nexa Resources ((“Nexa”) NYSE: NEXA; TSX: NEXA) initiated drilling with two core rigs at Florida Canyon in early November. This first phase of drilling ended in late-December upon the onset of the rainy season in the project area when helicopter supported drilling is no longer operationally efficient. Nexa is planning on resuming drilling at the end of the rainy season, expected sometime in April. At that time, Nexa plans to accelerate drilling operations utilizing four core rigs operating simultaneously to complete the remaining 37 drill holes. Four holes have been completed to planned target depth and a fifth hole was abandoned due to technical drilling problems. Total meterage completed was 2,203 meters. All holes were located at the northeastern margin of the previous drilling footprint in the Karen Milagros zone. Assays are expected sometime in February.

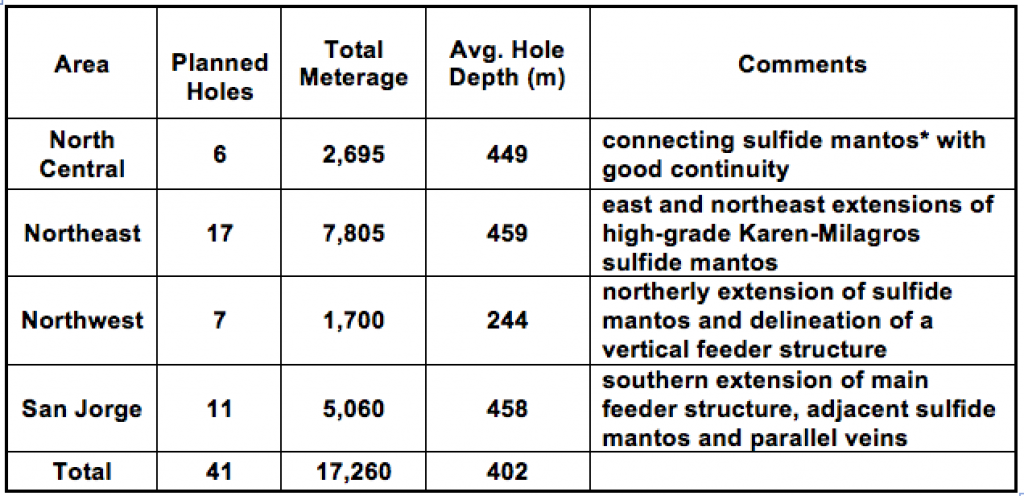

Solitario engaged SRK to develop an exploration plan at Florida Canyon aimed at identifying low risk/high-probability of success resource expansion opportunities at Florida Canyon. The study focused on defining significant new high-grade zinc-sulfide mineralization immediately adjacent to the existing defined resource. The study delineated a program that has high-potential to expand the current resource by over 50% with a 41-hole, 17,000-meter drilling program. A link to a video describing the exploration potential within and surrounding the Florida Canyon deposit can be found here.

On October 30, 2018 Solitario announced that drilling will commence within the next several days on its Florida Canyon zinc project in northern Peru. Two core drilling rigs with helicopter support have been mobilized to the site. All permits required to begin drilling have been received and a new 39-month community agreement has been signed. The program consists of drilling 41 core holes totaling approximately 17,000 meters (56,000 feet) designed to test highly prospective resource expansion opportunities identified by deposit modeling during preparation of the 2017 Florida Canyon PEA. Proposed drilling is focused on significant gaps and offsets within and around the drill pattern defining the known high-grade zinc-sulfide resource. Drilling is expected to continue until all 41 core holes are completed, but, depending on this year’s weather pattern, the rainy season may interrupt the program. The rainy season generally occurs from December through March.

Drilling will test for extensions of high-grade zinc-sulfide mineralization in four different areas of the deposit. (Map link to North Areas) (Map link to San Jorge). For complete May 23, 2018 release click here.

Table 1: 2018 Drill Target Areas and Proposed Average and Total Meterage (Source: SRK, 2017)

On February 12, 2018 Solitario announced the planned 2018 work program, additional property acquisitions and newly defined exploration opportunities on its Florida Canyon Zinc Project in Peru. Highlights of the planned 2018 work program include completion of the access road into the mineralized portion of the project area and permitting that will allow new underground tunneling, surface drilling and other activities associated with the future development of the project.

The terrain at Florida Canyon is steep and all previous project access supporting surface and underground work programs was conducted by helicopter. The lack of road access restricted the scope of field activities to further advance the project. With the completion of the road, heavy equipment will be able to enter the project area and allow feasibility related activities to proceed efficiently. Important future activities that will be facilitated by the completion of the road are the construction of an underground tunnel into the Karen-Milagros high-grade zinc zone, detailed underground resource/reserve definition drilling, surface drilling designed to increase the project resource and additional feasibility/infrastructure-related studies. Work is scheduled to begin in May after the rainy season ends and continue until the road is completed.

Approximately 5,400 hectares (13,300 acres) of new concessions covering prospective geology and geochemistry were acquired by the project in late-2017 on the northern border of the Florida Canyon claim block. Earlier in 2017 Nexa filed for 6,500 hectares (16,100 acres) of new concessions. The consolidated Florida Canyon land position now stands at 48,700 hectares (120,300 acres). A current property map can be accessed here

Golden Crest Gold-South Dakota

Projects:

Florida Canyon

> Technical Reports

> Photography

> Historical Drilling Results

This web site also contains information about adjacent properties on which we have no right to explore or mine. We advise U.S. investors that the SEC’s mining guidelines strictly prohibit information of this type in documents filed with the SEC. U.S. investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.